While the magnitude of the global pandemic is greater than any recession, the beauty industry appears to be one of the few who may experience a rapid rebound, according to the latest McKinsey report.

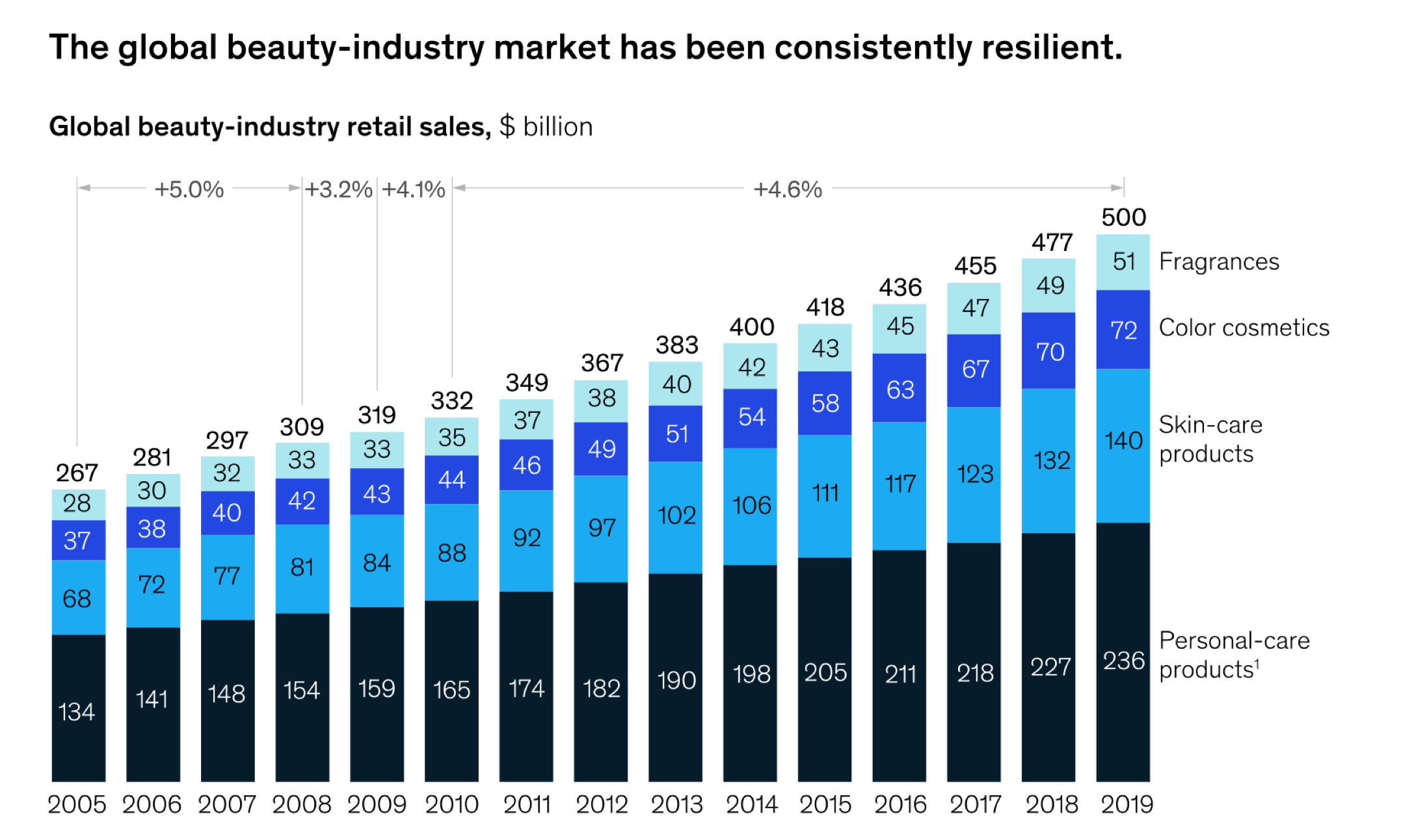

The global beauty industry has seen steady revenue increases since 2005, and will likely weather the COVID-19 outbreak even if sales drop a bit, especially at the luxury end.

McKinsey & Company predicts that global beauty industry revenues could fall 20 to 30 percent this year, but this bump in the road should correct itself in the coming years. If the pandemic has a recurrence later in the year, the decline could be as much as 35 percent.

“Even though the economic magnitude of the COVID-19 pandemic on brands and retailers will be far greater than any recession, there are signs that the beauty industry may once again prove relatively resilient,” McKinsey said the report. “In China, the industry’s February sales fell up to 80 percent compared with 2019. In March, the year-on-year decline was 20 percent—a rapid rebound under the circumstances.”

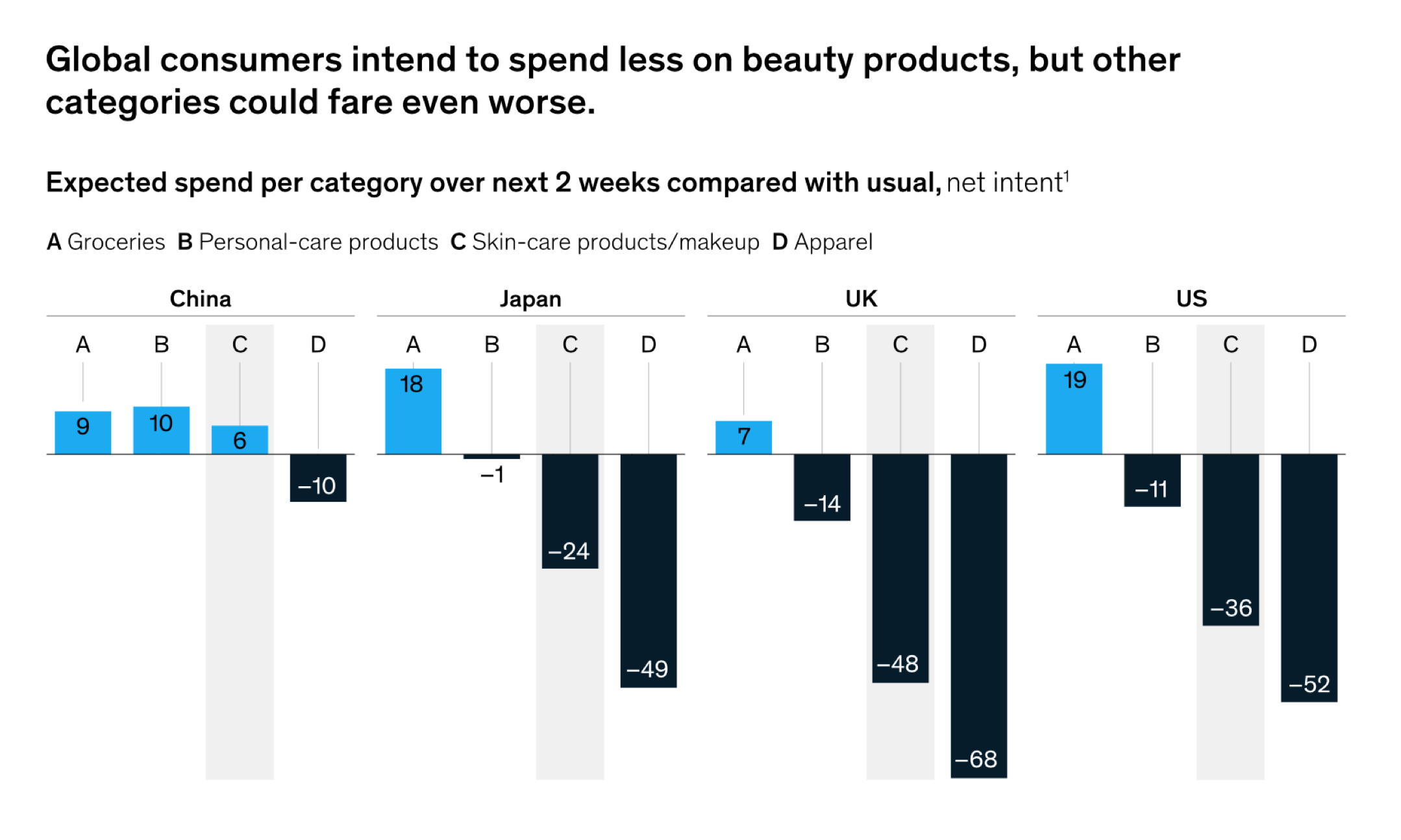

Global consumers plan to spend less on beauty products. Image credit: McKinsey & Co.

Luxury Hit

That said, luxury beauty brands will be hit the hardest in the coming year, with McKinsey predicting 55 to 75 percent declines in cosmetic and fragrance purchasing, respectively, versus a year ago.

“When consumers do return to work, many will continue to wear masks, further slowing makeup’s recovery,” the report said. “One possible exception is above-the-mask treatments.”

Despite the dire outlook for luxury, the pandemic has not been the hardest on beauty. Interestingly, some beauty-product brands and retailers with inventory and shipment operations that can scale are seeing e-commerce sales twice as high as pre-coronavirus levels. LVMH-owned Sephora’s U.S. online sales are reportedly up 30 percent over 2019. Amazon’s beauty-product sales saw the same increase in online sales during the four-week period ending April 11.

In China, online revenues among beauty brands and retailers are up 20 to 30 percent. Luxury hand soap sales in France were up 800 percent the week of March 16, as the country went into lockdown and prepared to be more hygienic. Europe’s largest e-commerce site, Zalando, saw a boom in self-care and pampering beauty products, up 300 percent year-over-year.

But an increase in online sales is not making up for the decline in in-store sales, according to the report. Even though bricks-and-mortar stores and mass-market and grocery stores have been open during the crisis, customer traffic is down and cosmetics revenues are wavering.

Looking to China, which has already emerged from the crisis, there are hints of slow re-openings and shy shoppers. Ninety percent of drugstores, grocers, beauty-product specialty retailers and department stores in China were reopened by April 15. However, traffic remains down 9-43 percent, as compared with pre-COVID-19 levels. Mall-based stores, in particular, have been slow to recover in China. Some 60 percent of large Chinese malls have seen a 30-70 percent decrease in sales in the first quarter of 2020, as compared to the same quarter in 2019.

“Despite store re-openings in China starting the week of March 13 and reports of ‘revenge spending,’ sales have not fully bounced back,” the report said.

Retailers and brands are now relying on promotions to push sales and process inventory. Even several luxury brands have offered discounts upwards of 40 percent to push sales, which is a highly unusual move among these firms.

“As beauty-product brick-and-mortar stores reopen, we expect to see more promotions aimed at reclaiming customer foot traffic,” read the report. “Given the realities of working from home, physical distancing and mask wearing, it has become much less important to wear makeup and fragrance.”

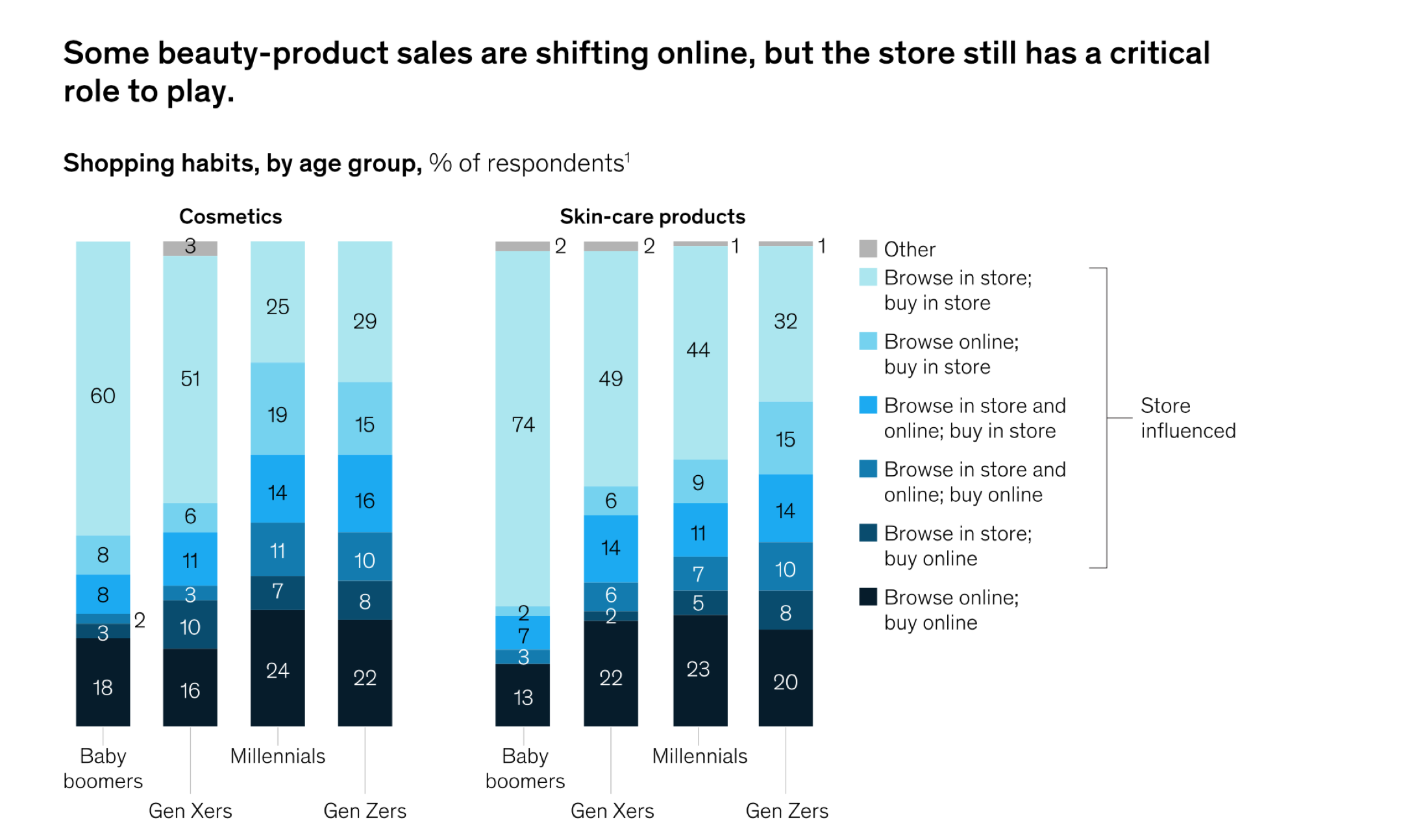

Beauty product sales are shifting online. Image credit: McKinsey & Co.

Outlook Expectations

Not surprisingly, consumers expect to spend less on beauty products in the near term, mostly driven by color cosmetics. However, as compared to other categories including footwear and apparel, the outlook is not as bad.

During the 2001 recession consumers still spent on lipstick, which is often considered an affordable luxury. These items may still be purchased this year. In most major beauty industry markets, shopping at retail bricks-and-mortar stores accounted for up to 85 percent of beauty purchases before the health crisis.

Even U.S. millennials and Gen-Zers bought 60 percent of their cosmetics in physical stores. These closures have hit the industry and will be difficult to recover from. Approximately 30 percent of the beauty-industry market was shut down from the pandemic and some of these stores will not reopen, according to the report.

“While the beauty industry may be in a relatively stronger position than other consumer categories, 2020 will be one of the worst years it has ever endured,” McKinsey said in the report. “We believe, however, that the industry will remain attractive in the long run.The COVID-19 crisis is likely to accelerate trends that were already shaping the market, such as the rise of the global middle class and the use of e-commerce, rather than mark entirely new ground. Consumers across the globe are showing by their actions that they still find comfort in the simple pleasures of a 'self-care Sunday' or a swipe of lipstick before a Zoom meeting.”

The global beauty market's historic sales. Image credit: McKinsey & Co.

Republished with permission from Luxury Daily. Edited for content and clarity. Image credit: Sephora.