For specialist watch retailers like The Hour Glass, the focus is now on perfecting the offline experience rather than ramping up e-commerce efforts, as Group Managing Director Michael Tay shares.

Why Offline Experiences Matter More Today Than Ever Before

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

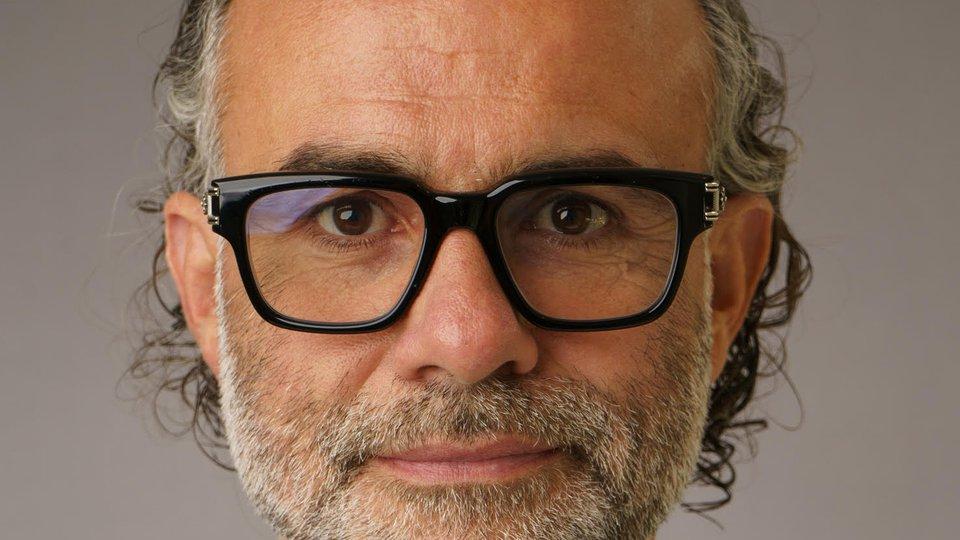

For specialist watch retailers like The Hour Glass, the focus is now on perfecting the offline experience rather than ramping up e-commerce efforts, as Group Managing Director Michael Tay shares.

Michael Tay is not an easy man to get hold of. It took several emails and a couple of months before Luxury Society finally managed to clinch a slot in his schedule – and for good reason too. As Group Managing Director, Tay has been fully occupied checking in on The Hour Glass’s retail boutiques (as well as sizing up his competitors’ shops) across the globe. All this to gather feedback and better improve the client experience in the luxury watch retailer’s 40 stores worldwide.

“I have discovered a fundamental lack of storytelling that goes into the entire sales ceremony. It's still largely too transaction. We don't spend enough time building rapport, discovering the needs of the clients, and then at the same time, wrapping it with beautiful stories of the brand and products,” Tay muses.

Which is why, he explains, the group is now focusing all its efforts on improving overall service standards across its boutiques. “If you tell a good and credible story and offer expert opinions and advice, people will come to you whether its digital or in the physical realm,” he adds.

In your opinion, where is the watch industry now in terms of adapting to today’s digital landscape?

I think the watch industry in general is at least 15 years behind the rest of the luxury goods sector when it comes to the adoption of new technologies, new communication methods, etcetera. We are largely a 500-year old industry, and there are a lot of deep seated, fundamental core biases in the sector, so it has taken a while for leaders within this industry to recognise the need for change. But for the brands that have – such as Rolex, Patek Phillippe, Audemars Piguet, Richard Mille and Hublot, to name a few – much success has been achieved in this area. I don't know of a single millennial today that isn’t engaged on social media. I think for any brand today that is thinking about its customers of the future, social media platforms and going digital is a necessity.

How has The Hour Glass embraced this digital push?

I think a lot of people have spoken about digital journeys, digital transformations. When we decided to embark on our official transformation, we were very clear from the outset that digital transformation was really just a byword for organisational cultural change. At that point in time, I think we still operated in the mode of an early-2000s business model. I don't think we sufficiently adapted ourselves or prepared ourselves for the changes that were to come. So some of the key things we did were ensuring that our ERP systems were upgraded, and putting a CRM programme in place. Previously, we were largely focused on network expansion. It was time to put the customer back into the centre of everything we did.

What is it that consumers of today are looking for when it comes to luxury watches?

I think they have a far greater expectation of the value that we can add as a specialist luxury watch retailer. They expect more specialist knowledge. And the fundamental reason is because before somebody even comes into the store, they would have already done their research online 84 percent of the time. When they come to us, what else can we tell them that they don’t already know? It comes down to anecdotes; brand storytelling. Which is really the heart of it, and the underlying basis of, why many of these individuals are buying watches begin with. It's not just because it's a good product – they're buying the underlying values and association of that product to this specific brand.

Join Luxury Society to have more articles like this delivered directly to your inbox

I assume the bulk of these consumers today are millennials.

Well, our consumers are getting younger. By virtue of the fact that the majority of our clients are aged between thirty to forty-five, many of them are starting to become millennials as the years go by. What's very clear is that millennials value experiences over material objects. And that's why many of them rather spend money going away on holidays, as opposed to an object that could literally last generations. While holidays may be rather ephemeral, lasting no more than a week to 10 days, they retain these memories for a lifetime, and have pictures to go with it. When you think about it in a very rational manner, it doesn’t make any sense. Because once you consume, you expend. Why would they trade it off? So we have to ask ourselves, how do we entice them to also desire to have that similar type of memorable experience while they are making a watch purchase?

In other words, your strategy is to focus on creating experiences for consumers and providing them with special memories to tie the product to?

Yes. It is something that I feel the industry has to pay more attention to. I spend the bulk of my time today focusing on the qualitative aspects of how to improve the client experience in the boutiques. The value we can add as a specialist luxury watch retailer is our expertise in this specific domain. Consumers are dealing with a human being on the other end, who can provide them with specialist consultations; compare and contrast one to several watches for them. And so we have built a learning and development department, where we have a team of trainers coaching our team on the ground. We’ve developed a series of in-house certifications, where sales people have to go through a number of tests – a lot of which is centred on brand and product knowledge – to reach the level of a specialist consultant.

Our aspiration is to be the Four Seasons of the specialty luxury watch retail business; of the special luxury watch retail sector. I think for a hotel with multiple properties around the world, they have been able to standardise a high level of quality service. That's what I would like to be able to accomplish and achieve with the 40 boutiques that we have in The Hour Glass group. It's a high expectation. It's a high ambition. But I believe we can get there.

Malmaison by The Hour Glass aims to provide customers with a unique shopping experience.

Many watch brands are also venturing into e-commerce to meet millennial shopping patterns. What is your take on this?

I think e-commerce for watches is good, but it's still in its infancy and it will take a long time for it to truly come to fruition. This is due to two very simple reasons. In the new primary market watch space, e-commerce hasn't really taken off the way it should (like other categories in the luxury sector) because number one, the average ticket price of an item is significantly higher than all other luxury goods categories sold online. The second reason is because of global exchange rates, global taxes, import duties, and global pricing indexes – there isn’t a sense of global pricing parity. And when you don't have global pricing parity, it's very difficult to accomplish this objective.

So e-commerce isn’t exactly a priority for The Hour Glass at this point, then?

It's not a priority for retailers like us who deal exclusively in new watches through authorised dealerships. Even our key brand partners haven't given us a mandate to sell their products online. I think e-commerce works in markets where there are distinctively large geographies. So for countries like the US and China, it does make sense. When it could take a consumer one to several hours to get to his closest specialist watch retailer, it makes sense. But the markets that we operate primarily in are generally very dense cities. So there is no need for that right now.

How do you decide on an appropriate E-commerce strategy for your brand?

Has The Hour Glass tested out this theory?

We ran a capsule campaign last year just as an experiment, where we collaborated with Nomos. We produced 75 watches for sale and released all of them online globally. We gave clients two options: They could pay then have the watch shipped to them so they wouldn’t have to come to the store, or they could click and collect – pay online, and then collect it in the store. Guess what the percentage split was between the two? 100 percent. 100 percent chose to click and collect. So it was an interesting exercise because we wanted to test whether there was this real desire to purchase online and have it shipped. And yet, when we gave people the opportunity to, they still wanted to come into the store.

So the general concern about e-commerce eventually diminishing the importance of physical stores is unfounded?

I think e-commerce will continue to grow. That's very clear. And I think anybody who says e-commerce is not going to grow is fooling themselves. But I also believe that the business of physical luxury goods stores will also continue to grow in parallel. Especially for those brands that get the in-store experience right. As things grow in a more digital-centred direction, I think offline experiences matter even more. Because as things become more digitised, there is less physical engagement, making those moments where there is physical engagement or interaction all that much more important.

Editor, China, Luxury Society

Previously based in Singapore at luxury lifestyle publication Prestige, Lydianne now creates China-related content across a broad range of topics. Experienced in dealing with both brands and consumers in the luxury industry, Lydianne is also Marketing & Communications Director at DLG China.