The luxury watch market in China is changing rapidly with consumers tending to go for secondhand, vintage timepieces over contemporary watches.

The Rise of the Secondhand Watch in China

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

The luxury watch market in China is changing rapidly with consumers tending to go for secondhand, vintage timepieces over contemporary watches.

It is hardly surprising to hear that watch auction sales are particularly buoyant at the moment compared with modern watches, when a single vintage watch goes under the hammer for a figure approximately equivalent to the turnover of a medium-sized contemporary watch company!

Few people have pointed out the possible link between the boom in vintage watches and the anti-extravagance campaign in China. Yet, discussing the issue with experts in the field in Hong Kong, the link seems obvious.

Do you need technical expertise on driving local revenues in China?

When luxury hides its face

“In the fight against extravagance and corruption, vintage watches are more low-profile than contemporary ones,” underscores Jessie Kang, Head of Watches at Sotheby’s in Hong Kong. Added to this is the fact that the buyers are more mature and better educated on the subject of watchmaking and its history. At the moment we’re seeing a transition of the market from the contemporary to the vintage watch.”

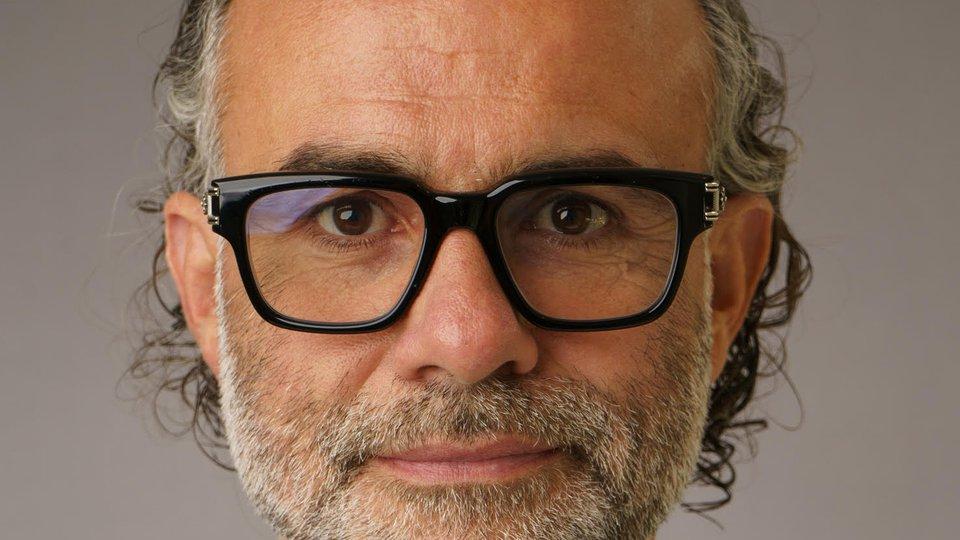

Image credit: Sotheby's. Image: Jessie Kang.

Simone Woo, an expert with Phillips’ Hong Kong subsidiary, confirms this: “The market is changing rapidly. Originally, the Hong Kong market was strongly geared to modern watches, but recently we’ve seen a transition towards vintage watches. And new players are joining the market.”

Among these new players are the Chinese auction house Poly Auction, a sister company of Poly Group, a huge public Chinese conglomerate. Drawn by the vintage boom, this company established itself in Hong Kong five years ago and now employs a workforce of around 100 people: “Our advantage is that most of our customers come from continental China, they already know us via Poly Group and now they’re really starting to get interested in our collectors’ watches,” says its watch head, Karen Ng.

The Patek Philippe, Rolex and Richard Mille trio

Poly Auction also holds auctions in mainland China itself. There too, it’s the same story: “Owing to government policy, people are tending to go for more conventional, discreet and subtle watches. Of course, the Chinese still like famous names like Richard Mille and they still buy them, but they don’t necessarily wear them in such a flamboyant way as before, more in private, with friends…”

That’s right: Richard Mille. Beside giants Rolex and Patek Philippe, this independent brand has achieved the feat of gaining outstanding popularity in the Far East, not only for its contemporary products, but for any of its products put up for auction. But vintage is not really the word, in the case of a brand founded in 2001…

Image credit: Richard Mille. Image: RM 027 Tourbillon.

“Our colleagues at Poly Group help us orient mainland buyers towards watchmaking,” Karen Ng goes on. For the moment, watch sales are small compared with auctions of ceramics or Chinese art, but the potential is huge! At Poly Auction just like at Sotheby’s, they’re trying their hand at ‘cross-selling’: sometimes it’s literally just one step, into the room next door, from antique porcelain to (relatively) antique watches, as sales of these two – for the Chinese – symbolic objects are systematically held at the same time and at the same venue.

Diversification of auction offerings

This autumn, at its Important Watches sale in Hong Kong, Sotheby’s found a taker for a 2015 Richard Mille RM56-02 Sapphire Tourbillon at 14,500,000 HKD (1,850,000 USD) and a Patek Phillipe Ref. 5002 Sky-Moon Tourbillon in pink gold at 11,020,000 HKD (1,400,000 USD).

As proof that watchmaking is gaining greater maturity in Asia, increasing numbers of less well-established brands than the above-mentioned ‘trio’ are also to be found up for auction, as Jessie Kang at Sotheby’s points out: “We sell watches by Philippe Dufour, Voutilainen, Romain Gauthier and MB&F;. Philippe Dufour is very popular for its ‘simplicity’, you have to appreciate every detail! A large number of collectors already have so many watches by traditional brands that they’re looking to diversify their collections,” she continues.

At Phillips, the most popular brands, we’re told, besides Patek Philippe and Rolex are F.P. Journe, A. Lange & Söhne, Richard Mille, Philippe Dufour, Audemars Piguet, Vacheron Constantin, Jaeger-LeCoultre, Heuer and Universal. “The taste of Asiatic collectors used to be slightly different from that of Occidentals originally, but with globalisation, the internet and social media the differences are being ironed out. There are some peculiarities, for example collectors in South-East Asia have a pronounced taste for tropicalised dials,” explains Simone Woo at Phillips.

No official figures exist, but in terms of growth, the secondhand market has by now overtaken that of modern watches, with physical auctions and online sales between private individuals, whether on Western platforms such as Amazon or Chrono24, or Asian ones like Alibaba or Taobao.

Article originally published on Europastar. Republished with permission.

Cover image credit: Patek Philippe.

Publisher, Europa Star

Serge is the publisher of Europa Star, a leading independent watch magazine that celebrates 90 years of coverage of the industry. Aimed at both professionals and collectors all around the world and in five languages, it provides unique point of views and exclusive analysis of the evolution of the watch industry.