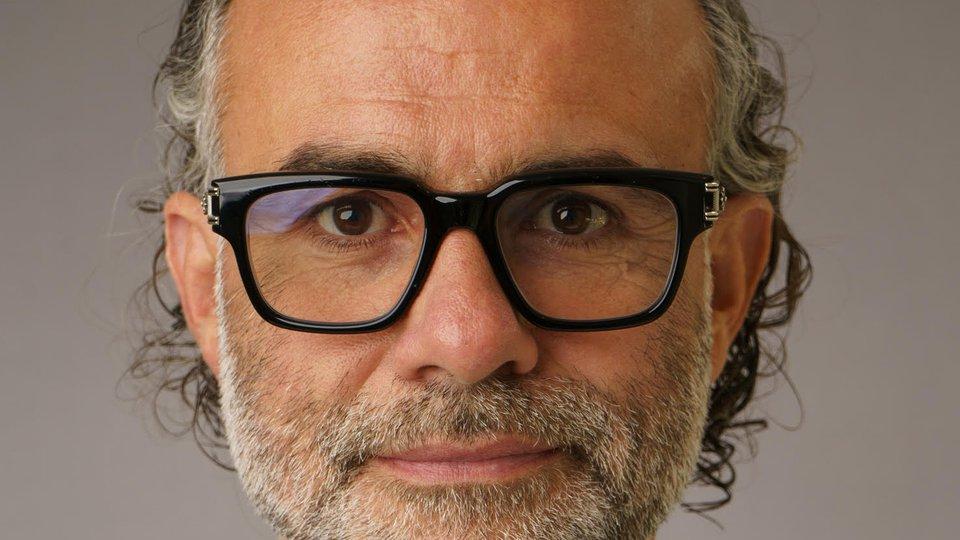

Mike Flewitt, Chief Executive Officer of McLaren Automotive reveals his road to the future for the iconic sports car marque.

Interview: Mike Flewitt, CEO, McLaren Automotive

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

Mike Flewitt, Chief Executive Officer of McLaren Automotive reveals his road to the future for the iconic sports car marque.

Mike Flewitt, Chief Executive Officer of McLaren Automotive reveals his road to the future for the iconic sports car marque.

Hailing from an enviable racing heritage that dates back to the 1960s, it would almost be an understatement to say that McLaren is an iconic sports car marque. Yet, despite the fact that it may share the sports car tag with other well-known brands such as Lamborghinis, Ferraris and Porsches, McLaren has managed to differentiate itself by staying true to its formula of melding technology, engineering and craftsmanship with a fiery charisma which stems from its raw racing background.

In its Chief Executive Officer, Mike Flewitt, McLaren has found a veritable match to balance both its legacy and a pure path to its future. Flewitt, who was appointed to the helm in July 2013, following a year’s stint as Chief Operating Officer from June 2012, is what you could undoubtedly call a true automobile aficionado.

As he says himself: “I’m an engineer come manufacturer, but I love cars. I adore cars. I have all my life.”

Other than his obvious passion for the product, like the marque, Flewitt also shares a formidable legacy in the automobile business, having previously worked for Ford, as well as AutoNova AB, Rolls-Royce and Bentley Motor Cars Limited.

However, and perhaps most importantly, Flewitt is a leader who has clearly mastered the art of distilling his passion for the product and respect for the brand and its history, into a clear strategy for its future, while still staying true to its roots.

In a time where many luxury brands choose to diversify and conquer, Flewitt bucks the trend by remaining steadfast to his strategy for exclusivity and focusing only on what McLaren has, and has always, done best.

“For me, it’s been about defining the brand. The brand was born out of motor sports. It was started in 1963 by a guy who’s an engineer and a racing driver – Bruce McLaren. The defining factor of McLaren motor sport was that it was always on the edge. It was always using technology to gain an advantage in motor sport. In a sense, that’s what we’ve taken into the automotive company.

“That’s something that defines McLaren versus another, and actually when I start thinking about a brand and what a brand means, the brands I love and respect are the brands that are really true to how they started, to what their base was.”

Interestingly, however, Flewitt’s ascension to the top job at McLaren – which includes the development, manufacture and global distribution of the range – came at the same time the company prepared to unleash its first deliveries of its most ambitious and technologically advanced product to date, the McLaren P1™.

Yet – even as the brand speeds towards its evolution under his direction – it’s Flewitt’s overall belief in maintaining the McLaren DNA as pure as possible that has not only provided a new birth for the brand, but also, paradoxically, secured the survival of its historic legacy.

“ I’m an engineer come manufacturer, but I love cars. I adore cars. I have all my life. ”

Kicking off with a conversation about exclusivity – several luxury brands these days are now diversifying into other product strands and it’s that sort of time where it’s very tempting to go one of two ways. What’s your view on that in terms of McLarens future vision?

I’ve looked and thought about this a lot over the last few years. I did spend time in the middle part of my career with Rolls Royce and Bentley when they were independent and so forth, but coming in here, I now design and build cars. That’s what I’ve done for 30 years. What’s unique about McLaren is really understanding customer base. Also, for me, it’s been about defining the brand. The brand was born out of motor sports. It was started in 1963 by a guy who’s an engineer and a racing driver – Bruce McLaren.

The defining factor of McLaren motor sport was that it was always on the edge. It was always using technology to gain an advantage in motor sport. In a sense, that’s what we’ve taken into the automotive company.

We use probably the most technically advanced products to give driver advantage, to give something special. That’s something that defines McLaren versus another, and actually when I start thinking about a brand and what a brand means, the brands I love and respect are the brands that are really true to how they started, to what their base was.

I have this belief that you buy a pen from someone who makes pens and you buy a watch from a watch company, and my wife buys a handbag at Hermes because that’s what they were. I don’t go and buy a Mont Blanc watch, for instance. I’m not saying they’re not great watches, but to me, what really defined brands was being excellent and seen as excellent and understood as excellent, often seen as being absolute best in the second, at what they did [from the start].

That’s been my passion around McLaren. What I always say is we’re a sports car company. Absolutely a sports car company. We’re not doing anything else. I’m not going to build SUVs. I’m not going to go for high volume. I’m not going to do that because of what our branding is, and what we offer our customers are the best drivers’ cars in the world: Pure sports cars.

We’re going to work on increasingly communicating that we’re the best sports car company in the world. The more we do it and the more each model that comes out confirms that, it builds our credibility, it defines our brand, and, in time, McLaren and world’s best cars in sport just becomes synonymous. You get to the point where almost it becomes a generic term or something because it is so well understood. I guess Rolls Royce is an example of that.

That’s what I see. Then we consider our customer base. By definition, our most accessible product as we describe it is still 140,000 pounds. That will remain our most accessible, and then we have models that go up to 2,000,000.

“ What we offer are the best drivers’ cars in the world: Pure sports cars ”

That’s quite a high price-point – how does that connect with the product and brand image?

Well, it won’t come below that, because we can’t deliver the technology that makes our cars so special below that price-point. That kind of dictates where our baseline is.

By definition, our customers are people with high-net-worth and some of the ultra-high-net-worth individuals. What do they want? They want exclusivity. They want something special. In any case, people want something truly unique. Something they can personalise.

All of those things to me, they are about luxury and luxury brands and that’s what we are, but we’re not arrogant about it. I know we’re not the best-known sports car brand in the world today, but I think we’re starting to be respected for what we do because of the quality of the products. Products and brand, they are particularly linked.

The McLaren P1™

Speaking of product and personalisation – ultra-high-net-worths have changed quite a lot in terms of demographics and location and culture. Given that, has it been a challenge to continuously keep your appeal to a wide range of ultra-high-net-worths?

There are a few elements to that. One is, we do have a pretty strong point of view about what we make. When we design a car, you can’t come and ask us to change the technical content engineered into that car because – and this is where we are arrogant I suppose – but we think we know best. What you can do is: You can come and change the aesthetics – the colour, the trim. You can personalise and do so much to make it unique to yourself.

One of the things that has happened without a doubt though, in a way, is that tastes in many ways have become more homogeneous. People, say for example in China, now know that people in New York, and the West Coast, and in Europe are buying and have and want the same. So, in one sense, the base car people want is the same base car all over the world, and that helps us because we have to build the car.

But then, you do get the taste element that comes in. You get taste driving very different things. Obviously, things like aesthetics. You could even walk down the production line and play a game by looking at the colour scheme and guessing where it’s going, because they are very, very different. The demographics are different.

Western Europe and East Coast US for example, are home to the more mature, traditional sports car buyers. They’ll be 50-60, typically self-made men, rewarding themselves. Very stereotypical, but that’s still very much the way it is.

Whereas, you go to China and they’ll be second generation or average age customers between 25 and 30, typically inherited money. They didn’t fund the business. They can indulge from an incredibly young age. I did a dinner in Shanghai not too long ago. We had the whole rooftop of their hotel. We invited all the customers in China and we sold 38 cars, which is unheard of. A few years ago you might have sold two. We sold 38 of these cars.

I was there to welcome them in and, honestly, I’d say average age was about 27. That right there is where you can see that our customers in each market are so different.

You’ve then got different buying habits as well. But fortunately, the fundamentals of our product go all the way – all the way back to base engineering. But we cannot appeal globally unless we tailor to some of these other differences.

“ You’ve got to get on the shopping list, and they’ve got to choose you ”

The US is a market which is driving good growth for many luxury brands — what is your stance on this particular market?

Economically, it’s growing slowly and steadily. For us, we are also growing. We don’t have the distribution and the representation in the US. We have 16 dealers right now, whereas, a brand like Ferrari – they’ve got about 60. So there are huge swathes that we don’t cover. We will grow as we become better represented. We’ll grow as our brand is better known and better understood and as long as the economics of the country are going in the right direction.

For us, as much as there’s growth because of the economy, a lot of it is to do with knowing our brand. I’m a manufacturing guy, not a marketing guy, but I always preach to our marketing team that when I did my Masters, there are two things I learned about marketing: One is you’ve got to get on the shopping list, and the second is they’ve got to choose you.

If somebody comes and tries our car, a very good proportion choose us more than you’d expect. The problem is, we’re not on the shopping list. If you’re an uninformed consumer, who’s just inherited a lot of money, that wants that lifestyle, and you want to go buy yourself a quarter-million-pound super car, you’re not saying McLaren.

In fact, it probably comes quite a way down that list because they haven’t heard of us. We haven’t been as established, we’re not as understood. We’re still very much an enthusiast’s brand. We’ve got to get more on that shopping list for people. Establishing our brand is actually as big an issue for us as what’s going on in society or the economies.

“ Establishing our brand is as big an issue for us as what’s going on in society or the economies ”

How do you decide then, where you go next to build your brand?

One factor to take into consideration is that you typically only buy cars like ours within 150-mile radius of the retailer because of service, support and all the things that go with it.

But the harder thing to understand is: What’s the appeal of our brand going to be in that particular locality?

We’re largely in unpredictable places. If you went round the US, you go to the West Coast, we’re in Beverly Hills, we’re in San Francisco, we’re in Newport Beach. We’ve got one in Calabasas, which is on the other side of LA. We’ve nothing further down.

We are looking at San Diego to see if that would make sense or not. We’re trying to evaluate the size of the market. We’re in places like Miami if you come up the East Coast. We’ve got one in Greenwich, and Philadelphia is actually a very good dealership for us. We’re in Washington DC and we’re, of course, down in Miami.

The only place we are in the middle of the country though, is Chicago. But that’s okay. There are quite a lot of wealthy people in Chicago. It’s not the top performing dealership but it’s not bad. In Texas we’ve got one, we’re going to open a second. That’s surprisingly strong. Stronger than I would have predicted it to be. We have a particularly good dealership in Dallas. They were our best retailer last year.

McLaren LMP1

Looking outside the US, Brazil and India have been a big point of discussion for some time for luxury. How are those types of emerging markets performing for motor cars?

Well, it’s different for different motor cars. At the moment for us I’m not quite sure that they will be big for us.

We’re not in India. We’re not in Russia. In South America, we’re open in Mexico at the end of the year. We are in Chile because we were approached by a retailer and were hugely impressed by him. We were sceptical about the volume though.

Volume is an important consideration, because we don’t want somebody to take on a dealership that’s not going to be profitable for them because it always ends up in a really bad position. We take a fairly responsible view about that, for our benefit long term also. But that retailer was very impressive. He understood, so we did sell it to him and he’s performed really well and we’re very happy with it.

In terms of other markets, I’d rather wait and be patient. In India, for example, the road network is dreadful. We sell cars that are great to drive. Great if you’re only selling things as a status symbol maybe, but the reason for our cars is they are so wonderful to drive and perhaps there’s nowhere to drive them properly in India. I think there’s about half a dozen cars in India that have been imported from the Middle East, but they’re definitely not ready for us.

In another sense though, if you look at it, in four years since June 2011 we’ve increased to 76 retailers around the world so you couldn’t say we’re cautious. But, when I go through the proposals, I’m very cautious.

“ We’re not going make our money on volume ”

What about Australia? Is this a market of more interest perhaps?

We’re in Sydney and Melbourne. I’ve got on my desk a proposal for a dealer in the Gold Coast and another in Brisbane, which are 45 minutes away from each other. Personally though, I think we need to be on the Gold Coast which is more of a holiday-ish place. This particular representative in Brisbane is promoting Brisbane though, so we’ll see.

It’s definitely a market with potential – Aston Martin, for instance – and you can tell I’ve just read this report – they get 30% of their Australian sales from Brisbane. Which was a much higher percentage than I had expected when I looked at it. Melbourne and Sydney do great though.

So what does your rate of production and distribution look like this year?

I reckon it’ll be about 100 cars a year for us, something like that. What’s good about doing all of this is that – and it’s strange, but – the more retailers we open, the more it drives exclusivity. We’re not going to produce more cars, so they actually get shared over more retailers now for a broader market, which means you’ve got less penetration actually in any particular market, but they’re more exclusive in any particular.

It’s a good business structure financially. We’re not going make our money on volume, we’re going to make our money on the pricing of the product. But there are a whole lot of other things we do for our customers off the back of it. We have a very strong relationships with our customers. They do a lot of events with us and so on, so they are part of the ownership experience.

This isn’t a chase volume situation for us. You can’t be, given our privatisation, so actually we have to make a future off the opposite.

“ In my perfect world people would make a choice based on what they want, not just on price ”

So, choosing the right price-point then is even more so an important consideration?

Well yes, but then, there are a lot of people that will choose products in the range, not just on price. And actually, with our cars, I’d like them to choose not just on price. Perhaps people do, because if you’ve got the money you always want the more expensive and the more exclusive, but actually, different cars, do different things.

Our most accessible car is actually in many ways the purest sports car of the whole range. If you go up to the next block which is 200-250, it [the car] has quite advanced things like active aerodynamics, etc, but it’s less pure if you’re a real driver. It’s actually more competent and faster, but it doesn’t have the same drive input.

In my perfect world people would make a choice between those two products based on what they want, not just based on price.

Driving is something that really depends on your tastes. If I race a 1963 car, it’s so pure and it’s all about sensitivity. For me, part of the pleasure is exactly that – because it’s just refining the skills and handling something. So, the races you go into, where you finish is down to your skill and not down to what the car is capable of. So that’s why I buy that car.

So it’s nice when you’re in that market and people are choosing through their tastes, through what they know. Yes, we want people to know our brand but I want them to understand our brand so they buy it.

Maybe it’s wishful thinking, but I want them to buy it and the perfect model for them, for the right reasons.

Inside a McLaren P1

So, if this is the ultimate vision, in terms of the marketing strategy for the brand then – what does that look like for McLaren?

Well, I’m not naturally a marketing person. I’m an engineer come manufacturer, but I love cars. I adore cars. I have all my life and I like this brand. So I’m very, very clear on what we’re trying to do with this brand. It’s almost – if you took the marketing element out of it – very pure in terms of what we want our cars to be.

Of course, you can’t ignore brand in this day and age because it’s what helps you sell, and price, and have the right business and all the rest of it, but I really believe that we can have that as a consequence of being so clear about our product, rather than the other way around.

“ I want them to buy it and the perfect model for them, for the right reasons ”

What has been your biggest learning during your time at McLaren and, basically, building the business almost from scratch?

It is really the conversation we’ve had around customers. Again, without being arrogant, I’ve been in the industry 30 years. I know how to make cars, and engineer cars and so on. I can work out the business side of it, but it is challenging. It’s very challenging for a growing company but we can do it.

Another challenge and learning has been really understanding our customers, and understanding how we can deliver this technical product, and accepting the reality that they’re not all going to buy from knowledge, and actually trying to going beyond that, into the market where people buy on reputation. Accepting that and working out how to appeal has been, and continues to be, really important.

This is really brought into view when you understand that nobody needs a McLaren but they want one. In a sense, the crux of it is creating this lust for it, because it’s not really an accessible car [because of the select volumes, pricing and distribution network]. You just don’t need it. So you have to create a really pure emotional connection. All logic aside. Logic is: we’re buying a BMW to drive to work every day.

So, even though you’re working in an incredibly logical, technical industry of making cars, a lot of the appeal with us has to be emotional. So you have to think: What is the emotional appeal of our cars? It’s loads of fun to drive. I’d love to think it was wholly how we drive but I’m not that naïve. But it’s partly how we drive and if you love driving they are the best sports cars in the world.

That’s part of the brand appeal and it’s wrapping all that up into something that remains pure to what we want to do and what we are – which is a ‘gang’ of engineers who love driving cars, who want to make the cars that we want to drive. We want to make the cars the world wants. That’s the premise, but I would say we are just scratching the surface. There’s so much more we can learn. So much more we can still refine, so that we absolutely deliver what a customer wants, but we keep pushing that desirability.

My perfect business model would be: We make 4,000 to 4,100 cars, but we still grow the business – which means we still grow the desirability, so you can drive growth pricing. That would be my perfect world, but learning how to do it is the challenge of an engineer.

For more in our series of conversations with Luxury Leaders, please see our most recent editions as follows:

– In Conversation With Robert Cheng, Group VP Marketing, The Peninsula Group

– In Conversation with Geoffroy De La Bourdonnaye, CEO, Chloe

– In Conversation With Caroline Scheufele, Co-President, Chopard

Additional editing by Daniela Aroche, Editorial Director of Luxury Society

Creative Strategist, Digital

Sophie Doran is currently Senior Creative Strategist, Digital at Karla Otto. Prior to this role, she was the Paris-based editor-in-chief of Luxury Society. Prior to joining Luxury Society, Sophie completed her MBA in Melbourne, Australia, with a focus on luxury brand dynamics and leadership, whilst simultaneously working in management roles for several luxury retailers.