Michele Sofisti, CEO of Sowind Group, reveals the opportunities & challenges facing the timepiece industry, from the perspectives of JEANRICHARD and Girard-Perregaux

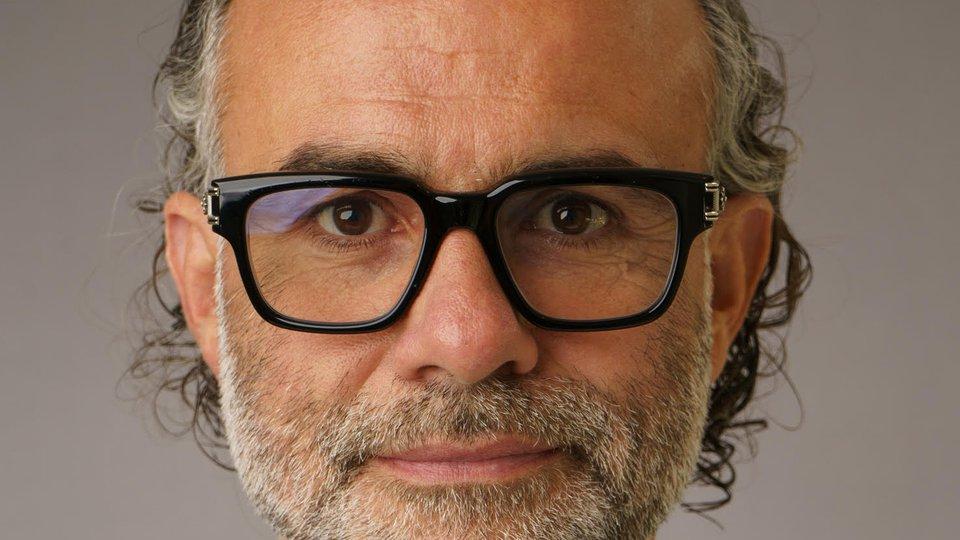

Interview: Michele Sofisti, CEO, Sowind Group

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

Michele Sofisti, CEO of Sowind Group, reveals the opportunities & challenges facing the timepiece industry, from the perspectives of JEANRICHARD and Girard-Perregaux

Michele Sofisti, CEO of Sowind Group, reveals the opportunities & challenges facing the timepiece industry, from the perspectives of JEANRICHARD and Girard-Perregaux.

In mid-2011, Kering became the majority shareholder of Sowind Group – home to Girard-Perregaux and JEANRICHARD – in a bid to bolster the activities of it’s small stable of watch and jewellery brands. The move gave the French conglomerate it’s first big push into the world of complicated timepieces and it’s first base in Switzerland.

The investment gave the acquired brands access to Kering’s network of advertising and distribution channels, alongside the financial independence to pursue a global expansion strategy. In August 2011, Michele Sofisti, the CEO of Gucci Group Watches, was brought in to oversee the overhaul for each of these historic brands, whilst maintaining his responsibilities with Gucci.

The trained geologist began his career in watches at Swatch Group, joining as Vice-President – and becoming President – of OMEGA. He subsequently served as President of Fred Jewelers and Christian Dior watches at LVMH, then held the position of President of Swatch AG (Switzerland) for five years before launching his own consulting company.

During his tenure at Gucci Group Watches, he has been widely credited with successfully repositioning Gucci’s product offering within the watchmaking market. And, under his leadership, both JEANRICHARD and Girard-Perregaux are making significant progress towards a prosperous future.

We spoke with Michele about the opportunities and challenges he is facing as CEO of Sowind Group in an ever-changing market for luxury timepieces.

“ We reworked JEANRICHARD from the logo to the branding, to the product & the price ”

For the Sowind Group, what one word best describes your strategy?

The strategy for each of the brands is quite different. For Girard-Perregaux after the acquisition by Kering, we decided the main strategy was to bring Girard-Perregaux into modernity. You have a brand with a 220-year-old history – always working during those years – but because of that, the brand was looking too much to the past.

Now, with our product development and marketing and communications strategy we are really trying to give a message for the future. Maybe it’s not easy. But I think in the last two years we have really created a clear line to follow product and communication wise, which is forging a company that is very dynamic, very modern and a company that can be a big player in the future.

For JEANRICHARD the strategy is completely different. With JEANRICHARD there is also a long history but in the last ten years it became a little bit lost. So we decided nearly three years ago to start from scratch.

We reworked the entire company from the logo, the branding and of course the product, price positioning, look of the point of sales etc. So today you have a completely new company, which in this moment is having quite relevant success. In less than one year have opened point of sales in over forty countries around the world, which is a significant result.

JEANRICHARD 208 Seconds Aeroscope

For those who may not be familiar, can you talk us through the Sowind portfolio in terms of price and positioning?

With Girard-Perregaux we haven’t changed the price positioning. We are a Manufacture, we have more or less the same price that we had in the past. At the high end we have pieces that start around 150,000 to the hundreds of thousands of Swiss Francs, particularly those with movement complications, in gold or with precious stones.

The one thing we did do is create two new families of products, the Hawk collection and the Traveller collection. And we decided to start with different materials to gold, like titanium and steel, which means entry price positioning at around 12,000 CHF. This helps to attract a different clientele, younger customers, which is an approach that has been quite successful in the last two years.

JEANRICHARD is again a completely different strategy. With JEANRICHARD we completely changed the price positioning. The company was before around 7-8,000 CHF with manufacture movements. Today we offer an outsourced movement with an entry price of 2,500 CHF, going up to14,000 CHF for a gold piece with an in-house manufacture movement.

So it’s a larger spectrum but in reality the bulk, say 90% of our collection, would be between 2,500 – 5,000 CHF.

“ There are plenty of competitors, everyone is investing & there are many big efforts from all types ”

As the market becomes more and more saturated, what do you feel differentiates Girard-Perregaux or JEANRICHARD timepieces from other brands?

The saturation of the market is a fact. In both segments for both brands there are plenty of competitors, everyone is investing and there are many big efforts from all types of players. What we try to do to differentiate our brands is to get inside the roots of the two companies and create something more modern and efficient, compared also to the competitors.

If I take for example Girard-Perregaux, what today differentiates us from our competitors is the Constant Escapement watch. Not only the watch itself – which is quite a beautiful watch – but the technology that we have achieved.

This technology and innovation remains within the roots of Girard-Perregaux. Since the beginning it has been an innovative brand and throughout it’s history you can see many moments when the brand has introduced an evolution.

And it’s similar with JEANRICHARD, we have a watch case construction for the whole collection that is very complicated and very high profile compared to all the other watches on the market.

You see a JEANRICHARD and – I think in a few years – you will say this is a JEANRICHARD, there is no confusion with other brands. So saturation yes, there is a lot of competitors. But I feel that we are able to achieve a personalization for the two brands, which is quite relevant.

Girard-Perregaux, La Chaux-de-Fonds Manufacture

Which geographical markets are you currently experiencing the strongest growth?

In this moment it’s difficult to answer with a list of markets. But what I would like to say is that we were not very well balanced, we were too dependent on Asia. And today it doesn’t matter what business you are in – watches or otherwise – it’s very important with all the globalization that a brand tries to be balanced.

So we are trying in the last two years to rebalance the markets and give more weight on the Americas – North and South – where both of our brands were not super performing. So far are sales are quite balanced in each region in terms of Girard-Perregaux and JEANRICHARD.

At the same time today, I must say, we are very successful in Switzerland, we are also doing well in cities like Paris and we are very strong in the Middle East. We are coming up nicely in Japan and then of course, the work we need to do here in the United States and Latin America.

We try to make or presence more or less similar in all the different markets. The point for me was that we were too dependent on Asia, and today it doesn’t matter what business you are in – watches or otherwise – it’s very important with all the globalization that a brand tries to be balanced.

Now, our geographical strategy is to work with top distributors. We have a strong retail strategy, but we are not going to open up boutiques all over the place. We have boutiques where there are no alternatives, but our strategy is much more to work closely with top retailers and important distributors to balance our distribution everywhere in the world.

“ It’s very important with all the globalization that a brand tries to be balanced across key regions ”

Which markets do you feel present the biggest opportunities in the coming decade?

We will keep pursuing the Asian markets, particularly China. And we are going to invest and continue to invest in China, Japan and Southeast Asia and improve our presence. I just don’t want to be fully dependent on those markets, we need also to build a strong United States, a strong Latin America and bolster our activities in various European markets.

Girard-Perregaux Sea Hawk

Recent Richemont results have re-ignited the discussion about a ‘hard luxury’ slowdown in China. What is your experience within the Sowind Group?

It’s a fact. China is slowing down because of these anti-corruption laws. But I must say very directly that I welcome these laws. People are losing sales but at least this will force all of our brands to create real sales, not sales because of gifting or whatever nature.

So yes, there is a slowdown, but China is still the number one economic market around the world and it will keep moving very strongly and very fast in the years to come.

So for me, it is welcome when something comes to make brands rethink their strategy, to make corrections on their path. You cannot really create brand awareness and a successful strategy if you count your sales on gifts.

Gifts are nice, but you need to service real clients, service the customer of the country of the market, you can’t just build a future on automatic sales. So there is no doubt that it is difficult and everyone is worried but I welcome it. We hope it will show something positive in the year come.

“ It’s a fact. China is slowing down because of these anti-corruption laws, but I welcome it ”

How would you describe the ‘typical’ customer for each of the brands?

To me it’s very difficult to answer the question for the fact that in the last two-and-a-half years we have really changed the look of the two brands. And probably before it was a profile for a technical client for each of the brands, but today it is really shifting.

I think that with the new products, like the Hawk collection and also the high-end pieces like the Constant Escapement, we are attracting completely different clients to what we were before. So I think a younger client, also a client with a taste for bigger watches, which we didn’t have before.

Three years ago at Girard-Perregaux, 90% of the cases were maximum 41mm, today we have quite a nice offer at 44mm and the Constant Escapement is even 48mm. In this way, through the product, you change slightly the type of clientele.

Girard-Perregaux Constant Escapement L.M

How do your marketing strategies reflect the interests and desires of these consumers?

The marketing and communications mission for each of the two brands is very different. Girard-Perregaux needs to have a strategy to position the brand in the future. JEANRICHARD needs marketing to create visibility, to let people know that the brand exists.

For Girard-Perregaux, our marketing is causing people to step back and say ‘Wow, I didn’t expect this from Girard-Perregaux.’ We have deliberately partnered with figures and foundations outside of the typical timepiece realm, for example we support the We Are Family Foundation alongside Nile Rodgers.

No one would have thought three years ago that Girard-Perregaux would venture into the music world with a musician like Nile Rodgers, or the Ocean Protection that we do with Susan and David Rockefeller, or the strategy that we have created with the younger watchmakers.

All of this is really showing a different Girard-Perregaux and I think attracting a different clientele. That’s why today I am absolutely unable to tell you who is the typical type of client, as there is no more a typical client, it is really depending on the different regions and on this evolution that we are continuing.

“ I don’t believe in a direct retail strategy at the moment for Girard-Perregaux, perhaps in a few years ”

How would you like to balance brand-owned, third-party and online retail in the future?

We have a few subsidiaries in the United States, Japan, France, Italy, then in key markets we tend to work with very high end distributors – all Greater China, Southeast Asia, Germany just to mention a few. And we try really to have a strong presence in strong points of sale.

At this stage I don’t feel that we need our own boutiques. I don’t believe in this retail strategy for the moment for Girard-Perregaux, perhaps in a few years, but I think for now it is better to partner with good people, with people who can bring passion into the equation and present the brand correctly to clients.

We are very happy leveraging digital communications to help build brand awareness, but at this moment there is no plans for a retail strategy online.

JEANRICHARD 1681 Ronde

What is the next opportunity you would like your company to seize?

It always comes down to the product and the communications. In product I feel this year at Baselworld, after the Constant Escapement, this year we are going to show something that is quite technical and forward in terms of innovation.

For Girard-Perregaux we must keep going with innovation, so we are investing a lot in R&D;, and this is what we need to do because otherwise we lose credibility. We are obliged – not every year – but at least every second year to come up with something important from an R&D; standpoint.

For JEANRICHARD we need to forge a clear evolution of the collection, the collection is very well based and established but we need to present new materials, new definitions, new details and so forth. Those are the opportunities that we have to leverage to overcome the competitors.

“ Competitors are there and will always be there. The biggest challenge is ourselves, our team ”

What is the biggest challenge the brand will face in the coming years?

The biggest challenge is ourselves. Honestly, we need to have not just a few people but the entire company moving in the same direction. Competitors are there and will always be there. We cannot influence the world economy, we need to face whatever comes.

To me the real challenge is to motivate our own people, our team. I can personally create a strong team spirit, but I then need everyone within the company and our distributors and subsidiaries and retailers to follow the same strategy. It’s not easy. So I hope to – with the help of my people – be able to really unite the entire company behind a strategy and work together to push the brands even further forward.

Girard-Perregaux Vintage 1945

Are you concerned about a future skills shortage in the watchmaking industry?

Honestly not really. At Girard-Perregaux not at all because we are a Manufacture so we do our own movements, and components I think will come. With some elements there is always a question mark but I am sure that we will always be able to find a solution.

For JEANRICHARD it is a little bit more difficult, because if the company – as we hope – has a great success then some movements may be difficult to get, but there are alternatives.

And in this sense I am quite pragmatic, I feel that if we have a challenge we will find a solution, and there are solutions. I am committed to developing a clear vision so we can anticipate any troubles.

“ I think we don’t need to limit our production, but we certainly need to create a clear collection ”

Given discussions regarding over-saturation in the luxury industry, can you see a point where your brands may limit growth to protect exclusivity?

I see the point you make with your question but I think we don’t need to limit our production, we need to create a clear collection, which I think we have today.

And we need to try to overcome some of our competitors, to become still a high-end limited-production company because we are not a volume company, but we also need to grow. We need to have more turnover, more volume and I think we can achieve all of this.

So our philosophy is not necessarily limitation, our philosophy is to have the best partners, to create and reach the cruising speed that we need.

We have not yet reached that cruising speed, we still have the possibility to grow, production wise we are able to do it, components wise we can also do it, so we have everything there to grow a little bit more.

For more in our series of conversations with Luxury Leaders, please see our most recent editions as follows:

– In Conversation With Caroline Brown, President, Carolina Herrera

– In Conversation With Maximilian Büsser, Founder, MB&F;

– In Conversation With Domenico de Sole, Chairman, Tom Ford

Creative Strategist, Digital

Sophie Doran is currently Senior Creative Strategist, Digital at Karla Otto. Prior to this role, she was the Paris-based editor-in-chief of Luxury Society. Prior to joining Luxury Society, Sophie completed her MBA in Melbourne, Australia, with a focus on luxury brand dynamics and leadership, whilst simultaneously working in management roles for several luxury retailers.