Chinese Affluent Luxury Shoppers: Lessons for 2017

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

While North America has traditionally given the most revenue for luxury brands, China now takes 30% of the global luxury market, which means it has become a huge source of revenue.

With the growing affluence of the Chinese in 2017, it becomes more apparent that luxury brands need to strive harder to understand the Chinese consumers, in order to best manage their marketing efforts and strategy in the market.

From this year’s research, Agility Research and Strategy has pinpointed 2 main lessons about the Chinese affluent consumers in 2017 that brands need to understand. Every year, we at Agility conduct our Affluent Insights Luxury Report in Mainland China, Hong Kong, Singapore and the United States to look at the current trends and behaviours among Affluent consumers, including rankings of preferred luxury brands.

Lesson 1: Confidence in Future Personal Finances Correlates with Aspiration to Purchase More Luxury Goods

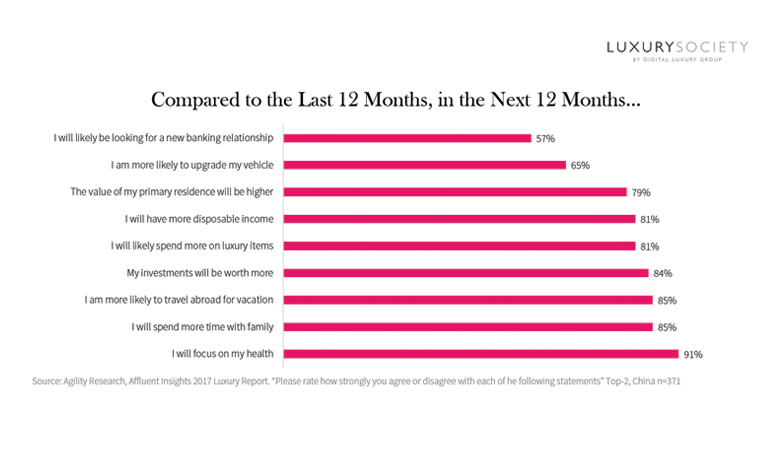

The first thing we found from our data is Affluent Chinese have become more health conscious and confident in their finances, with majority of them believing that they will receive more income and worth for their investments in the future compared to the last 12 months. Health is so important for this group that 91% say they will focus on their health in 2017.

A strong positive correlation can be seen between believing to have more income in the future with believing to spend more on luxury items, with a correlation coefficient of 0.52.

1 means a perfect positive correlation, 0 means no correlation, and -1 means perfect negative correlation – with all the other values in between showing how strong the correlation is. Positive correlation means that when comparing two factors, factor b is likely to also increase when factor a increases.

It’s an easily understood concept: people would buy more luxury goods when they have more money. However, it is often unsupported by data, but by common sense alone. Through our data, we have been able to support this concept.

What this implies is that quantitative economic growth indicators, such as GDP per capita growth, can still become an important indicator to the growth of luxury market.

We can also see that more than 4 in 5 of them also believe that they are more likely to spend more on luxury items as well as to travel abroad, which brings us to our second lesson.

Lesson 2: Digital Luxury is Great, but Brands Must Also Focus on Travel Retail and Retail in Travel Destinations

We found that a large majority of Affluent Chinese consumers are likely to travel abroad in the future. In fact, in the past 12 months, 66% of them have travelled at least 2 times for leisure and only 7% of them did not travel at all.

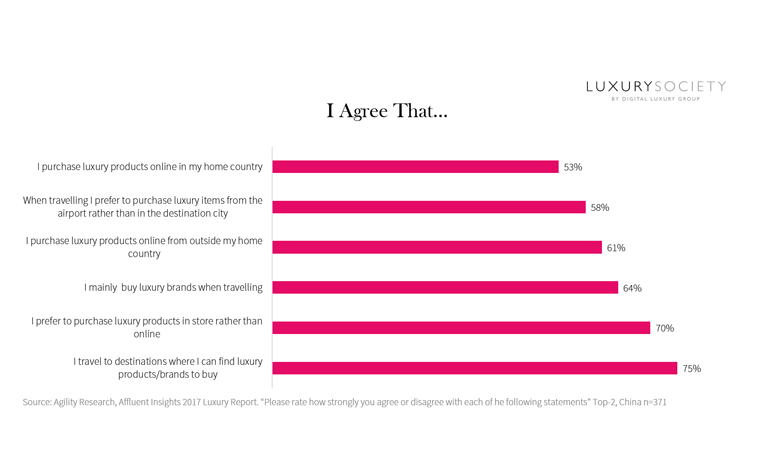

64% of Affluent Chinese mainly buy luxury brands while travelling, which is 11% higher than the 53% who purchase luxury online in China.

Luxury shopping at world famous shopping districts has become such an integral part of their luxury travel experience. From our past research, we learned that Chinese travellers are always excited to visit the famous shopping districts in their travel destinations, such as Shibuya in Tokyo or Orchard Road in Singapore.

Indeed, 70% of them agree that they prefer luxury purchases in store, whether at home or abroad, rather than online, which also indicates that the Affluent Chinese still enjoy the luxury shopping experience. But this experience must not be limited to downtown stores; 58% of Affluent Chinese prefer purchasing luxury items at the airport rather than in the destination city, so while they may shop both at the destination and the airport, the latter is still preferred, perhaps due to the them being duty free.

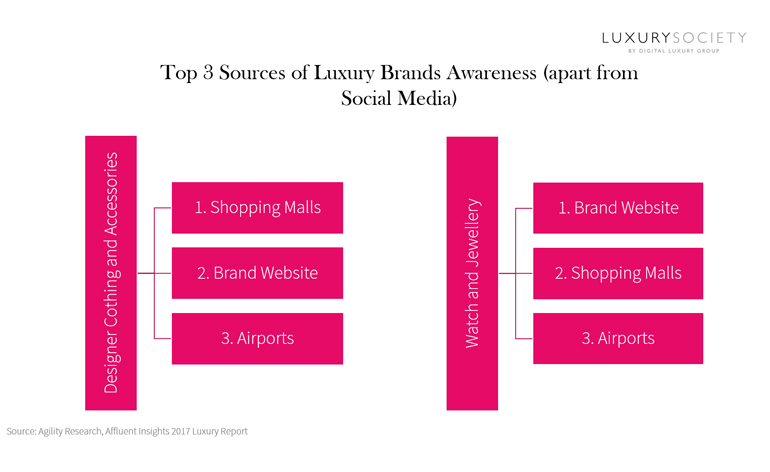

In addition, the airport has also become one of the top 3 sources of awareness for designer clothing and accessories, as well as watches and jewellery. This is a huge revelation for us as it shows that airport, which was only seen as an additional advertising space for brands, has finally become a crucial source of awareness for luxury consumers.

We believe that brands must start placing more attention on travel retail and luxury shopping as part of the travel experience for the Chinese consumers. Indeed, a new year brings new opportunities and new challenges.

And the most ideal place to start this year? It’s by looking at insights that combine luxury shopping with travel behaviours of the consumers from the world’s emerging largest luxury market. (http://agility-research.com/insights-on-affluent-asian-millennials-and-millionaires-at-the-nyt-luxury-travel-conference/)

Note:

For this research, Chinese respondents are required to have a minimum annual household income of RMB 350,000, with 1/3 of the total sample having a minimum of USD 1 million in assets which enables the market intelligence firm to slice through the data to look at insights that are specific to Chinese millionaires. For more details on the methodology, visit: www.agility-research.com

Managing Director, Agility Research & Strategy

Amrita Banta is managing director and co- founder of Agility Research & Strategy, ranked as one of the top 10 luxury research firms globally and the first luxury and premium insights and consultancy firm founded in Asia. To date, she has conducted more than 350 consulting engagements for some of the world’s biggest brands in the luxury, travel, and hospitality sectors.