Facebook is by far one of the leading and largest tech companies the world has ever seen. It’s been successful in keeping both users and advertisers happy. Cream UK’s Neil Cunningham investigates why there might be dark clouds in Facebook’s future.

Is Facebook’s Bright Future Obscured by Dark Clouds?

Over the last decade, collaborations between luxury brands and contemporary artists have gone beyond mere artistic partnerships towards a new kind of luxury branding.

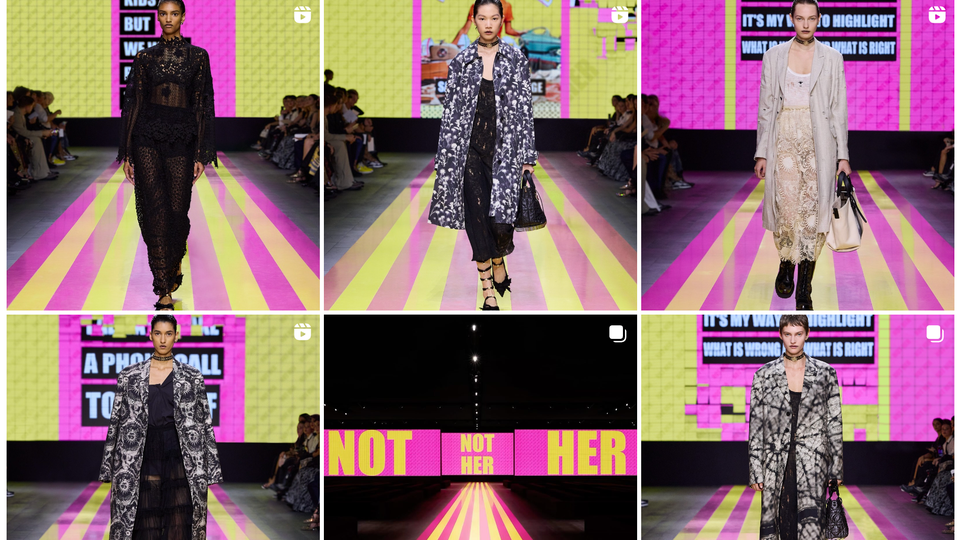

PARIS – Art and fashion have always developed side by side, for fashion, like art, often gives visual expression to the cultural zeitgeist. During the 1920s, Salvador Dalí created dresses for Coco Chanel and Elsa Schiapparelli. In the 1930s, Ferragamo’s shoes commissioned designs for advertisements from Futurist painter Lucio Venna, while Gianni Versace commissioned works from artists such as Alighiero Boetti and Roy Lichtenstein for the launch of his collections. Yves Saint Laurent’s vast art collection, recently auctioned at Christie’s in Paris, testified to his great love of art and revealed the influence of a variety of artists on his own designs.

In the 1980s, relationships between luxury brands and artists were advanced when Alain Dominique Perrin created the Fondation Cartier. In the Fondation Cartier pour l’Art Contemporain, a book marking the foundation’s 20th anniversary, Perrin says he makes “a connection between all the different sorts of arts, and luxury goods are a kind of art. Luxury goods are handicrafts of art, applied art.”

The Fondation Cartier pour l’Art Contemparain building in Paris

Facebook is by far one of the leading and largest tech companies the world has ever seen. It’s been successful in keeping both users and advertisers happy. Cream UK’s Neil Cunningham investigates why there might be dark clouds in Facebook’s future.

In what’s proving to be a tougher than expected year for US tech companies, Facebook continues to be the investment community’s darling.

Their latest results – sales up 52% year on year to $5.38 billion and profits up 200% to $1.51 billion – shattered all analysts expectations. And it’s not hard to see why they’re doing so well. Remarkable though it may seem, their user base is still growing – eMarketer predicts that active users will grow from 1.43 billion at the end of this year to 1.87 billion in 2020. And the amount of time that those users spend using the suite of Facebook apps (Facebook, Instagram and Facebook Messenger) is growing too – up from a daily average of 40 minutes last year to 50 minutes this year.

“ Facebook have done an excellent job of future-proofing their business ”

Not only do they provide an easy way to access virtually any audience that a marketer could require, they also offer an increasing number of engaging ways to target those audiences. The initial roll out of premium ads in the news feed two years ago has been followed by the introduction of a number of new ad formats – from video ads to carousels. This innovation has reached its zenith with Facebook Canvas, the most immersive format to date.

And lest investors should become skittish about a MySpace-style exodus to the ‘next big thing’, Facebook have done an excellent job of future-proofing their business too. Exodus of young users to another platform? No problem – just buy it (Instagram in this case). Emerging technologies such as VR threatening to change the ways people consume content? Easy, just buy the VR provider generating the greatest buzz – in this case, Oculus. Worried about the migration of people to messaging apps? Launch your own, Facebook Messenger, as a standalone product and buy the biggest rival – WhatsApp.

Facebook boasts widely popular platforms and business friendly products. They seem to have the knack of keeping both users happy and businesses happy. And they’ve got plenty of opportunities to continue to grow their revenues – not only as their audiences grow but as they continue to leverage their various platforms for their commercial potential.

Surely nothing can stop this revenue-generating juggernaut? Perhaps, but unstoppable as Facebook may seem, there are a few dark clouds gathering on the horizon.

“ We’ve gathered so many so called ‘friends’ on Facebook that we’re uncomfortable sharing personal information ”

A few weeks ago, a report started circulating about a significant change in Facebook users’ behaviour. According to Bloomberg, there’d been a sharp drop in the amount of content that Facebook users were sharing about themselves – a decline of 21% between 2014 and 2015, and a further fall of 16% so far this year.

Facebook responded by saying that the overall level of sharing had shown no signs of decline, but didn’t refute the specific claim about personal sharing. The likelihood is that users are sharing a greater proportion of non-personal content (e.g. viral content, brand page posts, etc) and a lesser proportion of personal content. And Bloomberg’s claim would certainly explain many of Facebook’s recent moves – developments such as Facebook Live and ‘On This Day’ are clearly designed to encourage users to share more personal details.

The problem is being blamed on a phenomenon known as ‘context collapse.’ Basically, we’ve gathered so many so called ‘friends’ on Facebook that we’re uncomfortable sharing personal information with such a wide and disparate group. Hence, we either don’t share it at all or share it on another platform where we have a tighter circle of friends.

“ to have one company with so much influence over digital advertising isn’t healthy ”

Why does Facebook care about this fall in personal sharing? Well, firstly personal information is rich in insights. Its access to this sort of data that makes Facebook so popular with advertisers. Secondly, as inferred above, if people aren’t sharing personal information on Facebook, they’re probably sharing those titbits on other platforms. This partial defection could mean less engagement in the short term and a gradual migration of activity onto other platforms in the future. If those platforms are Facebook owned – and there’s some evidence that some of this personal sharing is migrating to Instagram – it’s clearly not a problem. But if it’s not – and Snapchat is no doubt hoovering up a high proportion of this activity – then there’s cause for worry, if not alarm (just yet.)

For advertisers, this particular cloud may have a silver lining. Convenient as it is to have a one stop shop for all your digital advertising needs, to have one company with so much influence over digital advertising – Facebook receives around 50% of all digital display spend – isn’t healthy. As growth in audiences and dwell time on the platform begin to stagnate, as they must eventually, so advertising rates will inevitably escalate. The more options advertisers have, the less control Facebook has over the market and the more competitive that digital ad rates will be.

In that respect, happy Facebook investors in the future won’t necessarily equate with happy Facebook advertisers. Marketers should be crossing their fingers that, in coming years, the smiles of Facebook shareholders aren’t quite so wide.

Managing Director, Cream UK

Neil is responsible for the agency’s day-to-day running and overall strategy. He joined in 2012 to revitalise Cream’s digital and social arm after his success as head of online at Dentsu Aegis, Vizeum. Made MD in January 2015, Neil has overseen a period of rapid development, integrating traditional media with data driven strategies. He graduated from Queen’s College, Oxford with a MA in Experimental Psychology.